State pension funds are subject to inflation, savings can be lost or stolen by fraudsters. Each banking structure operates in accordance with the requirements of local law, can go bankrupt or suffer from crisis. What will happen to retirement in 20-30 years, where it is safe to hide the accumulation "for old age"?

The creator of the Akropolis project integrates the capabilities of blockhouses and standard retirement funds. This app is built on flexible intelligent contracts, investment decisions made by accredited investors.

What is Acropolis?

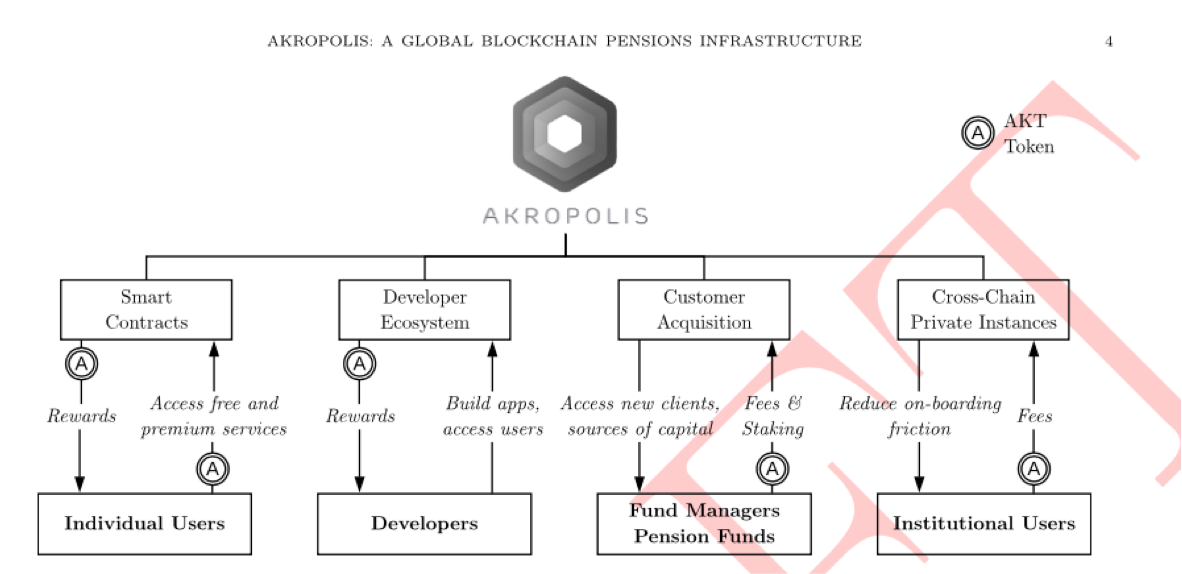

Platform Acropolis - a single system for storing and managing pension funds, built on blocking technology. Developers are trying to reduce inflation and economic risks, making pension savings more stable and profitable for users. The program includes functions for five categories of users.

Individual Users - individuals who want to save and increase retirement savings using Acropolis. The user receives an individual system access key associated with the public key.

The Pension Fund is a state or commercial pension fund that works through the Acropolis. These users create their own infrastructure, attracting new members (Individual Users) to allocate funds.

Investment Manager - asset manager placed. Individuals or organizations that manage assets placed on behalf of investors or private organizations (Pension Fund). The user's job is to maximize profits from other groups of participants.

Asset Tokenators are intermediaries that ensure "digitization" of real assets and confirm their authenticity upon request. For example, a retiree deposits a banknote on a non-state pension account registered with the Acropolis. Asset Tokenator confirms the total amount and "gives" the token to the user.

Developers are individuals and companies that develop additional functions for Akropolis users. For example, financial analysis tools, services for withdrawal of funds obtained.

The Acropolis platform operates in accordance with GDPR (General Data Protection Regulation), a document that ensures the protection of personal data of citizens in the EU. Good news for investors: this product is aimed at a large European market.

How does Acropolis work?

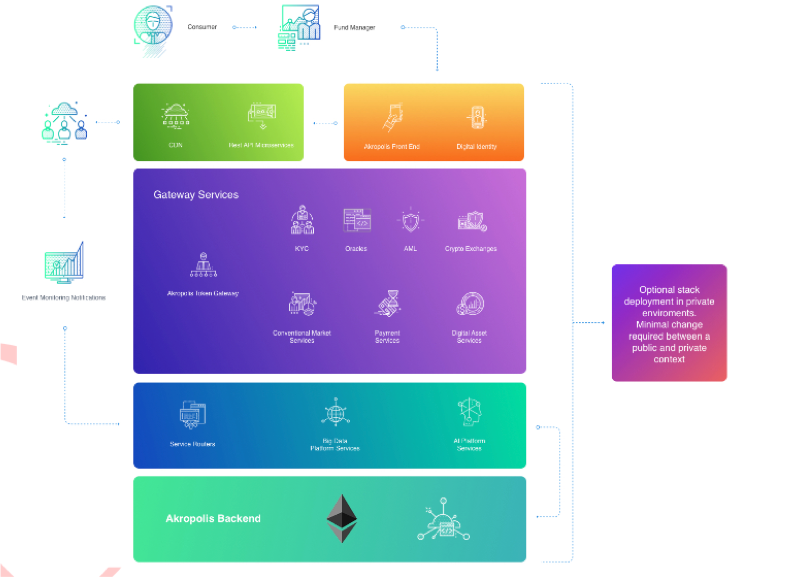

This system is based - smart and decentralized contract, blokcheyn transparent architecture. Transactions, personal user data and legal information are stored on the server. Working with Acropolis is built on three procedures:

Orientation. New user registration and document download is done once, user is given a sign to pay Investment Manager.

Reporting. Fund Manager reports on asset portfolios, each user can choose the right manager. Acropolis is a more flexible platform than non-government pension funds, existing tokens can be easily "moved" between projects.

Ranking and Reputation. Each platform user receives ratings depending on the number of assets, compliance with legal requirements, feedback. For example, the Asset Tokenator receives points for quick document verification.

Before working with Acropolis, users pass KYC procedures (know your customers), all personal data is stored on an off-chain server in encrypted form. Information about transactions and storage of pension assets is stored in the chain.

How will the ICO go and what will happen to the next Acropolis?

The developers released 900 million AKT tokens according to the ERC20 standard. Each coin is sold for 6.9 cents, USD, and ETH is accepted for payment.

The token released will be sold in the following proportions:

40% will be realized during ICO.

10% will be spent on supporting project advisors and early investors.

10% will be invested in ecosystem marketing and development.

20% will be spent on maintaining the development team.

20% will be a reserve fund and expenditure for project partners.

The team plans to collect 25 million dollars (hard cap), which is distributed proportionally:

50% of the funds are planned to be spent to improve technology and "find talent" - new developers in the team.

15% are planned to be invested in partnership with state organizations.

10% will cover the cost of marketing the project.

12% will be spent on legal registration of international platforms.

13% will cover unexpected operational and expense expenses.

According to Roadmap, project work began in the fall of 2017, the first version of Whitepaper was developed. Good news - documents created as a draft agreement between users and platforms, legal norms observed. The MVP project was established in early 2018, Akropolis smart contracts passed a third-party audit and subsequently published a rough Whitepaper.

Launch of a beta version of the product for companies and private customers is scheduled for late 2018, followed by mobile apps. The developers expect the use of free trials from Acropolis.

Results

The Acropolis project is the result of working with developers, programmers, and organizational members of the state. The project advisors are PriceWaterhouseCoopers, Kenetic Capital, Prime Block Capital.

What good is Acropolis for an investor? Target international audience, competent legal design, MVP outlined and abundant technical information at Whitepaper. How is the chance of Acropolis to succeed? Pension reform and economic crises are worrisome for the population around the world, therefore the platform will solve international problems with liquidity savings.

FOR MORE INFORMATION VISIT LINKS BELOW:

WEBSITE : https://akropolis.io/

WHITEPAPER : https://link.akropolis.io/whitepaper

FACEBOOK : https://www.facebook.com/akropolisio/

TELEGRAM : https://t.me/akropolis_official

TWITTER : https://twitter.com/akropolisio

AUTHOR:Gambangcity

ETH:0xbd4e6B6E19c55D117badfa5C218Ae03263df6072

Tidak ada komentar:

Posting Komentar